Effective July 2022, the Centers for Medicare & Medicaid Services (CMS) required commercial health plans (including employer-sponsored, small group, and individual plans sold in state and federal exchanges) to begin releasing and publishing their in-network negotiated rates and out-of-network allowed amounts through publicly available, machine-readable files. By leveraging the information provided in a sample of machine-readable file output, it is possible to identify how prolific APMs are by looking for outlier rates tied to specific levels of care, such as residential treatment and intensive outpatient treatment services. For instance, through a targeted query of residential treatment negotiated rates in the states of California, Missouri, and Georgia, we are, for the first time, able to determine that there are negotiated contracted rates ranging from $5,400 to $18,571. Some of these rates would greatly exceed the existing market per diems for these levels of care, which provides the evidence needed to indicate these contract prices are most likely unique bundled rates tied to APMs negotiated between the providers and a specific health plan.

To learn more about the power of transparency in coverage data available through commercial health plan machine-readable files, I connected with Cheryl Matochik, Third Horizon Strategies Managing Director for Market Analytics. Specifically, I focused our conversation on how providers can proactively leverage the transparency in coverage rate data to negotiate alternative payment arrangements with commercial health plans in various markets.

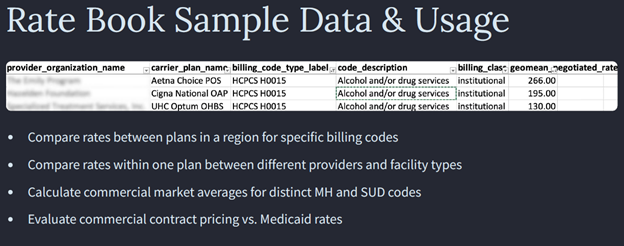

Cheryl: For most, this data is not on their mental health and SUD providers’ radars. Once they are aware and educated about this development, they are intrigued to compare their rates against the market and their peers to understand positioning, especially if they have a payer negotiation coming up and are looking to substantiate a rate or add a reimbursable service to a contract. Unfortunately, it is impossible for most providers to find, digest, and make use of this data. Because of the complexity of the machine-readable files and the way they are structured, most companies have to rely on a third-party vendor to process and evaluate this data to action. Therefore, providers most interested in this new insight have a good volume of patients coming through the commercial market or a material strategy to grow their commercial line of business.

Eric: How do you see these machine-readable files playing into the future of APMs and payer interest in pushing further away from fee-for-service day rates?

Cheryl: We see this data serving as an accelerant to health care companies reigniting their value-based strategic plans post-COVID. While the machine-readable files themselves don’t contain any information about the volume of services by a contracted provider or even whether a provider habitually performs a specific service, that information can be acquired from large claims data sets. By combining utilization data with pricing information contained in the machine-readable files, there are several new rooms in the house of health care prices that can be lit up to inform APM design. For example, we are working with a third-party administrator who is using this information to create provider-specific episode pricing to create an alternative payment model for a section of their network.

Eric: How do you think this data supports the further push for behavioral health providers to join networks—many of whom remain out of network currently?

Cheryl: Behavioral health provides can use the data to proactively push a compelling data-driven narrative of what a “fair rate is.” For example, we have a client for whom we produced a custom report which helped them substantiate a vital rate negotiation with one of their major insurance carriers. The outcome of this negotiation helped them to add nearly 120 SUD residential and detox services for in-network access that will ultimately save hundreds, if not thousands, of lives directly. As the community knows, in many instances, mental health and SUD commercial rates are on par or lower than Medicaid rates. However, this data is not a silver bullet that will fix the lack of providers in-network overnight. The data does not have the power to overcome other structural barriers facing providers in becoming part of commercial networks at an acceptable, sustainable rate. But the data mandate is good timing and combined with stronger parity in access and coverage enforcement, the dynamic can shift.

Eric: Where can a provider start by diving into this data?

Cheryl: For providers, a great starting place is to take the billing code list of their highest-volume services and look up those rates in their geography. The important thing is to make sure you locate the precise payer network files in your market and then thin the data down to your most relevant peer provider types to create the best apples-to-apples comparison of rates.

Cheryl: Compliance with the Transparency in Coverage mandate remains uneven, but the data that is available is already helping to shed light on prior zones of complete darkness. Thus, I encourage providers, in particular, to find a knowledgeable partner and start running queries specific to their use case whether that is an upcoming payer negotiation or expanding into new geographies or services lines. What they will learn about their competitive market will be eye opening and a data point they did not have before.

Eric: Cheryl, thanks for your thoughtful responses to this important conversation. You’ve given us a great deal to consider.

Third Horizon Strategies is a strategic, boutique advisory firm focused on shaping a future system that actualizes a sustainable culture of health nationwide. Staff located in 11 states support and lead client engagements spanning the country – from Washington state to Washington, D.C. The firm offers a 360º view of complex challenges across three horizons – past, present, and future – to help industry leaders and policymakers interpret signals and trends; design integrated systems; and enact changes so that all communities, families, and individuals can thrive. Learn more at www.thirdhorizonstrategies.com.